When it comes to trading, there are tons of Binary Options Indicators that are available. So many that in fact traders will often end up confused as to which Binary Options Trading Indicators should be used or for that matter, fail to understand what an indicator does. It is the lack of this information that leads most traders to use the wrong set of indicators when it comes to trading.

Although the trading indicators are primarily built for the Forex or stock markets, they can easily be used for trading binary options as well. If you are confused about what indicator to use, then read this article to gain a correct factual understanding about binary options indicators. At the end of this article, the reader will have a good understanding of the various indicators for trading binary options.

What are Binary Options trading indicators?

Binary options trading indicators are nothing but mathematical values that are plotted on the chart. The formulae used to derive these values are based on price. Price, as we know has four distinct levels. The Open (or opening price), Close (or closing price), the High Low; often referred to as OHLC for short. Based on these four values, the indicators are developed accordingly.

As you can start to understand by now, all indicators are derived out of price and there is nothing magical about using indicators.

Types of Binary options trading indicators

There are different types of binary options trading indicators and any indicator you come across can be mainly classified into any of these following types.

Trend Indicators: The trend indicators are usually plotted on the chart and overlaid on price. The most famous example for trend indicator is a moving average. What is a moving average? It is nothing but the average price plotted on the chart. The basic premise with trend indicators is that when current price is above or below the average price, it is determined that current price is in an uptrend or a downtrend.

Volatility Indicators: Volatility indicators mostly make use of high and low and in some cases the Open or close prices as well. Volatility based binary options indicators are plotted on the chart and overlaid on price. The most famous example for volatility indicators is the Bollinger Bands. Other volatility indicators are usually envelopes or bands based indicators, plotted on chart.

Oscillators: The oscillators are those indicators which oscillator between fixed levels. They are usually plotted in a separate window and commonly denote overbought or oversold conditions in the markets. In other words, Oscillators are used to identify retracements in the price. Oscillators are also plotted by calculating the price and it could be any of the four price points. The most common and famous oscillators include the MACD or Stochastics oscillators

Cycle Indicators: Cycle indicators are a bit more complex as they tend to plot the cycles, the peaks and troughs or the retracement dips or rallies in price. Cycle indicators look similar to oscillators and therefore people tend to confuse them and treat them as overbought or oversold indicators. Cycle indicators in fact are to be used to identify the start or end of retracements. The famous cycle indicator includes the Schaff Trend cycle indicator.

What binary options indicator to use and when?

The markets do not move in a straight line. It is often said that the markets trend only 20% of the time while range or move sideways 80% of the time. Therefore, doesn’t it make sense to use or apply the most appropriate indicator?

When the markets are trending the trend indicators are obviously the best choice. For example the moving average indicator is the best indicator to use as it reflects current price in relation to the average price.

Likewise, when the markets are moving sideways then using an oscillator that identifies overbought and oversold levels are the most ideal set of indicators to be used.

But what if you do not know which binary options indicator to use?

This is where most of the traders go wrong. The simplest way to eradicate this confusion is to make use of binary options indicators that are not redundant. For example most traders use an RSI alongside the Stochastics. There is no need for this as both these oscillators are basically the same thing, perhaps different in their calculation. Likewise, using a moving average indicator along with an envelopes indicator which is used to measure volatility is redundant. Most of the envelope indicators or ‘Volatility’ based indicators combine both trend and volatility into consideration.

Therefore traders always make use of two or more indicators (preferably a trend indicator and an oscillator) so that both these indicators can help the traders to trade in both trending as well as sideways and ranging markets.

With the above information, let’s move on to the next step and identify the 5 best binary options indicators and how you can apply these indicators into building a strong and a robust binary options trading strategy.

Five best indicators for binary options trading

All binary options indicators are categorized into the following types. It is therefore important to understand the types of indicators rather than focus on tons of endless indicators that promise to make you rich.

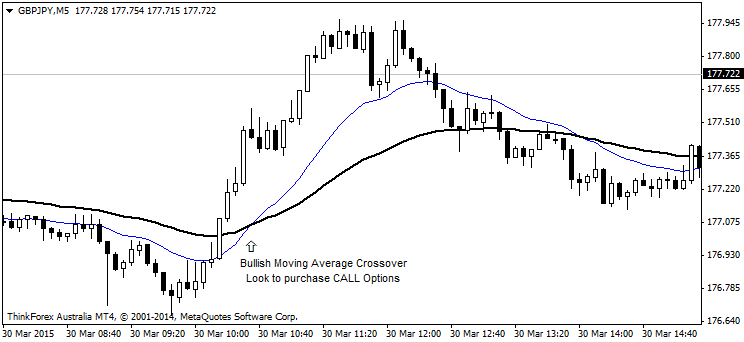

- Moving Average: The Moving Average indicator is probably one of the best trend based indicator that is available. It is flexible as it allows traders a lot of modifications such as setting the period to Close or Open, High or Low as well as changing the period and not to forget the different moving averages such as Simple, Exponential, Linear Weighted and Smoothed.You will use a moving average indicator for binary options trading, primarily to figure out the trend in the prices. If the prices are above the moving average, it indicates that the price is in an uptrend and vice versa. Also pay attention to the slope of the moving average as it usually signals a strong trend.

Figure 1: Binary Options Indicator: Moving Average/Trend

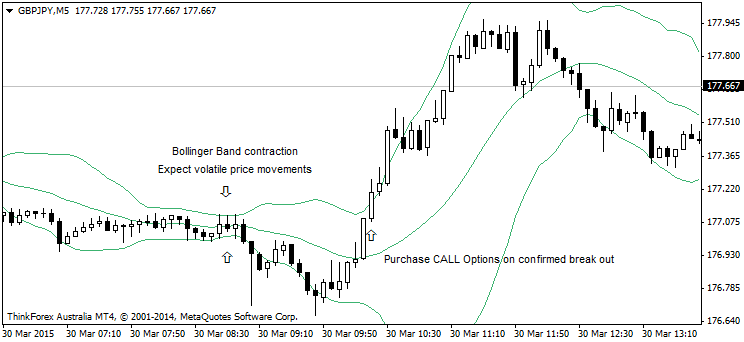

- Bollinger Bands: Bollinger Bands are versatile as the bands are squeezed and expanded based on the impending market volatility. You will use Bollinger Bands to capture break outs or for trading high momentum markets, example, before a major news release, Bollinger Bands tend to contract indicating a volatile move in the markets is approaching. The mid Bollinger Band is nothing but a moving average, so this indicator gives you two-in-one: Trend and Volatility

Figure 2: Volatility Break out Binary options Indicator

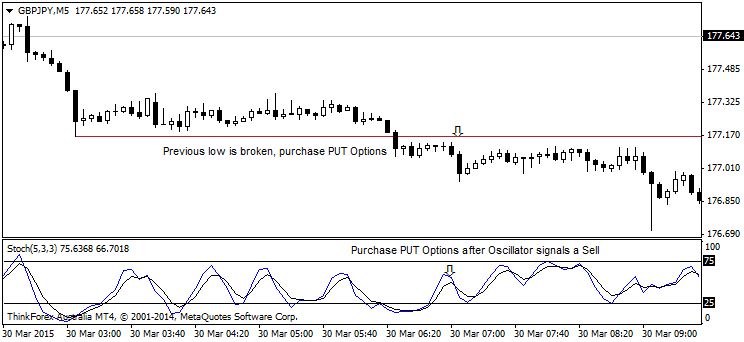

- Stochastics Oscillator: The Stochastics oscillator is a great indicator to use especially when you notice that prices are moving within a range. Besides using the Stochastics oscillator for just trading the sideways price action, it can also be used to identify retracements within the trend by simply following the oscillator when it crosses above or below 80 and 20 levels. You should ideally use the Stochastics oscillator alongside a trend or a volatility based indicator

Figure 3: Binary Options Indicators: Oscillators

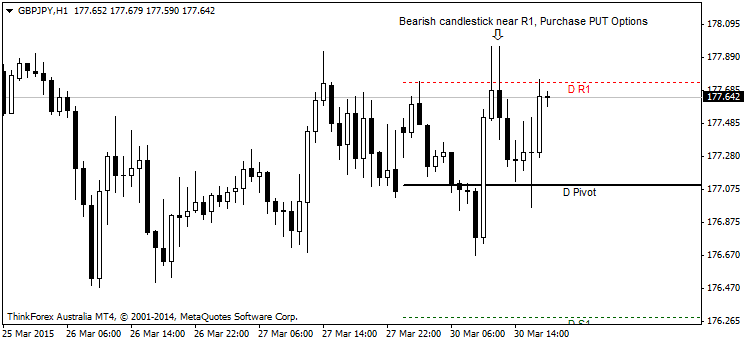

- Pivot Points: Pivot points are a trading tool and they technically fall into the category of an ‘Indicator’ Pivot points basically calculate and give you 7price levels based on the Open/High/Low and close from the previous day. The mid line is noted as the Pivot point followed by 3 resistance lines drawn above the pivot and 3 support lines drawn below the pivot midpoint. When price reaches the extreme support or resistance level, termed S3 or R3, it indicates either a continued trend or a reversal. Conversely, when price fails to reach the first support or resistance level, it indicates a potential reversal in the trend.

Figure 4: Binary Options Indicators – Pivot Points

- Price Action: Price action is probably the least understood and most confused trading concept. It is not an indicator but is an important tool for binary options traders and normal traders alike. Price action combines the use of candlestick patterns, support and resistance and chart patterns. It is not usually suited for the beginner of traders, but having an understanding of price action makes an important addition to your trading success. Price action is an entirely different school of study that requires a lot of time and experience putting it into practice. The added advantage with price action trading is that it compliments any indicator based trading strategy.

Figure 5: Binary Options Indicators – Price Action Trading

Binary Options Indicators – Build your own trading system

Now that you have an understanding of the various trading indicators which can be used in binary options trading, readers can start building up their own binary options trading strategy by make using of the various indicators pointed out in this article. By correctly identifying the indicators that you are using, binary options traders can combine the various types of indicators into building a strong and a robust binary options trading strategy.

Remember that if an indicator is not giving you the results that you desire, it is either that you are using the wrong indicator or perhaps you need to tweak the settings of the indicator. Most important of traits when using binary options trading indicators is the fact that you need to constantly tweak, fine tune and back test your binary options trading strategies in order to find the best settings and the best set of indicators to be used in your binary options trading.

When it comes to trading, there are tons of indicators that are available. So many that in fact traders will often end up confused as to which indicator should be used or for that matter, fail to understand what an indicator does. It is the lack of this information that leads most traders to use the wrong set of indicators when it comes to trading.

Although the trading indicators are primarily built for the forex or stock markets, they can easily be used for trading binary options as well. If you are confused about what indicator to use, then read this article to gain a correct factual understanding about binary options indicators. At the end of this article, the reader will have a good understanding of the various indicators for trading binary options.

What are Binary Options trading indicators?

Binary options trading indicators are nothing but mathematical values that are plotted on the chart. The formulae used to derive these values are based on price. Price, as we know has four distinct levels. The Open (or opening price), Close (or closing price), the High Low; often referred to as OHLC for short. Based on these four values, the indicators are developed accordingly.

As you can start to understand by now, all indicators are derived out of price and there is nothing magical about using indicators.

Types of Binary options trading indicators

There are different types of binary options trading indicators and any indicator you come across can be mainly classified into any of these following types.

Trend Indicators: The trend indicators are usually plotted on the chart and overlaid on price. The most famous example for trend indicator is a moving average. What is a moving average? It is nothing but the average price plotted on the chart. The basic premise with trend indicators is that when current price is above or below the average price, it is determined that current price is in an uptrend or a downtrend.

Volatility Indicators: Volatility indicators mostly make use of high and low and in some cases the Open or close prices as well. Volatility based binary options indicators are plotted on the chart and overlaid on price. The most famous example for volatility indicators is the Bollinger Bands. Other volatility indicators are usually envelopes or bands based indicators, plotted on chart.

Oscillators: The oscillators are those indicators which oscillator between fixed levels. They are usually plotted in a separate window and commonly denote overbought or oversold conditions in the markets. In other words, Oscillators are used to identify retracements in the price. Oscillators are also plotted by calculating the price and it could be any of the four price points. The most common and famous oscillators include the MACD or Stochastics oscillators

Cycle Indicators: Cycle indicators are a bit more complex as they tend to plot the cycles, the peaks and troughs or the retracement dips or rallies in price. Cycle indicators look similar to oscillators and therefore people tend to confuse them and treat them as overbought or oversold indicators. Cycle indicators in fact are to be used to identify the start or end of retracements. The famous cycle indicator includes the Schaff Trend cycle indicator.

What binary options indicator to use and when?

The markets do not move in a straight line. It is often said that the markets trend only 20% of the time while range or move sideways 80% of the time. Therefore, doesn’t it make sense to use or apply the most appropriate indicator?

When the markets are trending the trend indicators are obviously the best choice. For example the moving average indicator is the best indicator to use as it reflects current price in relation to the average price.

Likewise, when the markets are moving sideways then using an oscillator that identifies overbought and oversold levels are the most ideal set of indicators to be used.

But what if you do not know which binary options indicator to use?

This is where most of the traders go wrong. The simplest way to eradicate this confusion is to make use of binary options indicators that are not redundant. For example most traders use an RSI alongside the Stochastics. There is no need for this as both these oscillators are basically the same thing, perhaps different in their calculation. Likewise, using a moving average indicator along with an envelopes indicator which is used to measure volatility is redundant. Most of the envelope indicators or ‘Volatility’ based indicators combine both trend and volatility into consideration.

Therefore traders always make use of two or more indicators (preferably a trend indicator and an oscillator) so that both these indicators can help the traders to trade in both trending as well as sideways and ranging markets.

With the above information, let’s move on to the next step and identify the 5 best binary options indicators and how you can apply these indicators into building a strong and a robust binary options trading strategy.

Five best indicators for binary options trading

All binary options indicators are categorized into the following types. It is therefore important to understand the types of indicators rather than focus on tons of endless indicators that promise to make you rich.

- Moving Average: The Moving Average indicator is probably one of the best trend based indicator that is available. It is flexible as it allows traders a lot of modifications such as setting the period to Close or Open, High or Low as well as changing the period and not to forget the different moving averages such as Simple, Exponential, Linear Weighted and Smoothed.You will use a moving average indicator for binary options trading, primarily to figure out the trend in the prices. If the prices are above the moving average, it indicates that the price is in an uptrend and vice versa. Also pay attention to the slope of the moving average as it usually signals a strong trend.

Figure 1: Binary Options Indicator: Moving Average/Trend

- Bollinger Bands: Bollinger Bands are versatile as the bands are squeezed and expanded based on the impending market volatility. You will use Bollinger Bands to capture break outs or for trading high momentum markets, example, before a major news release, Bollinger Bands tend to contract indicating a volatile move in the markets is approaching. The mid Bollinger Band is nothing but a moving average, so this indicator gives you two-in-one: Trend and Volatility

Figure 2: Volatility Break out Binary options Indicator

- Stochastics Oscillator: The Stochastics oscillator is a great indicator to use especially when you notice that prices are moving within a range. Besides using the Stochastics oscillator for just trading the sideways price action, it can also be used to identify retracements within the trend by simply following the oscillator when it crosses above or below 80 and 20 levels. You should ideally use the Stochastics oscillator alongside a trend or a volatility based indicator

Figure 3: Binary Options Indicators: Oscillators

- Pivot Points: Pivot points are a trading tool and they technically fall into the category of an ‘Indicator’ Pivot points basically calculate and give you 7 price levels based on the Open/High/Low and close from the previous day. The mid line is noted as the Pivot point followed by 3 resistance lines drawn above the pivot and 3 support lines drawn below the pivot midpoint. When price reaches the extreme support or resistance level, termed S3 or R3, it indicates either a continued trend or a reversal. Conversely, when price fails to reach the first support or resistance level, it indicates a potential reversal in the trend.

Figure 4: Binary Options Indicators – Pivot Points

- Price Action: Price action is probably the least understood and most confused trading concept. It is not an indicator but is an important tool for binary options traders and normal traders alike. Price action combines the use of candlestick patterns, support and resistance and chart patterns. It is not usually suited for the beginner of traders, but having an understanding of price action makes an important addition to your trading success. Price action is an entirely different school of study that requires a lot of time and experience putting it into practice. The added advantage with price action trading is that it compliments any indicator based trading strategy.

Figure 5: Binary Options Indicators – Price Action Trading

Binary Options Indicators – Build your own trading system

Now that you have an understanding of the various trading indicators which can be used in binary options trading, readers can start building up their own binary options trading strategy by make using of the various indicators pointed out in this article. By correctly identifying the indicators that you are using, binary options traders can combine the various types of indicators into building a strong and a robust binary options trading strategy.

Remember that if an indicator is not giving you the results that you desire, it is either that you are using the wrong indicator or perhaps you need to tweak the settings of the indicator. Most important of traits when using binary options trading indicators is the fact that you need to constantly tweak, fine tune and back test your binary options trading strategies in order to find the best settings and the best set of indicators to be used in your binary options trading.